Power Purchase Agreement Canada

Power Purchase Agreements with Alberta Renewable Energy Projects

Why Enter into a power purchase agreement and Who Can Do It?

Power Purchase Agreements (PPAs) are a transaction structure that provide corporations the opportunity to profitably reduce their net carbon emissions without incurring any upfront capital expenditures. As of the start of 2023, at both current and forecasted market electricity prices, entering into a well-structured power purchase agreement with a renewable energy project in Alberta would provide corporations with both a profit on the transaction AND the associated carbon offsets power generated from the project.

As a result of these strong forecasted economics, corporations have entered into power purchase agreements with renewable energy projects in Alberta in order to:

1) Meet government mandated carbon compliance obligations (such as the Technology Innovation and Emissions Reduction Regulation in Alberta);

2) Offset hard to abate carbon emissions and achieve voluntary net carbon emissions reductions targets in order to meet ESG goals; and,

3) Hedge their long-term exposure to rising Alberta electricity and Canadian-carbon commodity prices.

What is a PPA and how does a PPA Work?

A PPA is an agreement to pay an electricity generator a predetermined price for each unit of electricity that the project generates. In return for this payment, the PPA Buyer receives either the physical delivery of the electricity (physical PPA) or the market price of that electricity received by the electricity generator (virtual PPA), along with the associated carbon offsets.

Thus, when the market price is higher than the predetermined price at which the electricity will be purchased, the PPA Buyer gets paid (or achieves electricity cost savings) and receives the carbon offsets. However, when the market price is lower than the predetermined price at which the electricity will be purchased, the PPA Buyer will pay the difference to the electricity generator (while still receiving the carbon offsets).

Wanting to enhance your understanding of electricity market revenue streams or regulations?

With a unique combination of knowledge in the electricity and carbon markets combined with financial expertise, Zenith Power can help accelerate your project development process and investment analysis.

Electricity market rules are continuously evolving to adapt to increased renewable energy penetration levels and the integration of energy storage projects. Following these regulatory changes and understanding their implications on your project’s economics is essential.

Zenith Power can support your team by:

- Monitoring and reporting on regulatory developments;

- Conducting data analysis on historical and forecasted electricity market pricing;

- Explaining the current provincial regulation on carbon pricing and advising on a carbon monetization strategy; and,

- Establishing a strategy to hedge market-based revenue streams and sourcing electricity off-take agreements in Alberta.

How Is It Possible To Make Money And Achieve Carbon Emissions Reductions?

In a Power Purchase Agreement, the PPA Buyer will receive the market electricity revenue and the value of the carbon offsets in exchange for a predetermined cost per unit of electricity.

Thus, if the market electricity revenue is higher than the predetermined cost per unit of electricity, the PPA Buyer gets paid while also achieving carbon emissions reductions.

The three main factors driving the strong economics of Power Purchase Agreements with wind and solar power generation projects in Alberta are: the declining cost of wind and solar energy system generation, rising electricity market prices, and rising carbon market prices.

A report published by Lazard on the levelized cost of electricity noted that the cost of solar and wind electricity generation had dropped by 90% and 72% respectively between 2009 and 2021. As a result, wind and solar energy project developers are able to profitably enter into power purchase agreements below both the current and forecasted market price of electricity in Alberta.

For example, the Government of Alberta announced that they entered into a PPA to pay an average fixed price of $48.05/MWh to three solar projects, and prices that ranged between $30.90 and $43.30/MWh to ten wind projects.

While other PPA contracts have not been publicly disclosed, it is likely that these prices currently represents the lowest PPA prices for solar power and wind projects in Alberta, as the government is a counterparty with a very high credit rating and ran a highly competitive auction process.

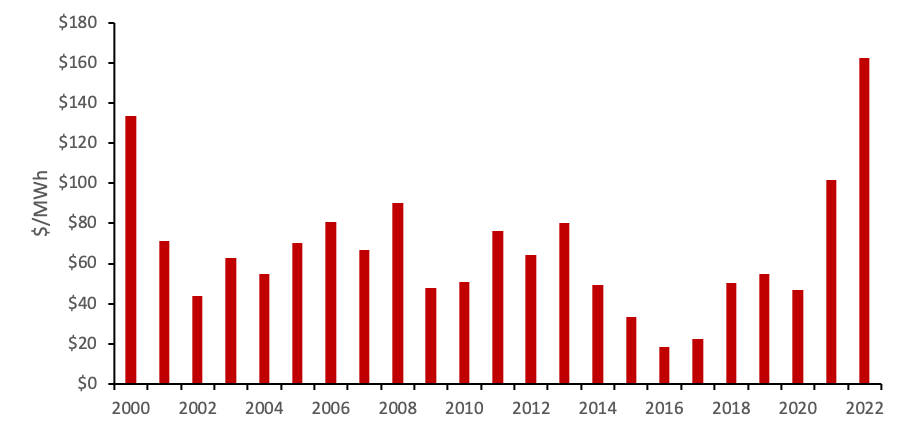

To put the above listed PPA contract prices into context, in 2021 and 2022 the all-hour average electricity price in Alberta was $102/MWh and $162/MWh respectively, with current forward curves and widely used long term market forecasts projecting prices to remain above the current cost of renewable energy generation for the foreseeable future.

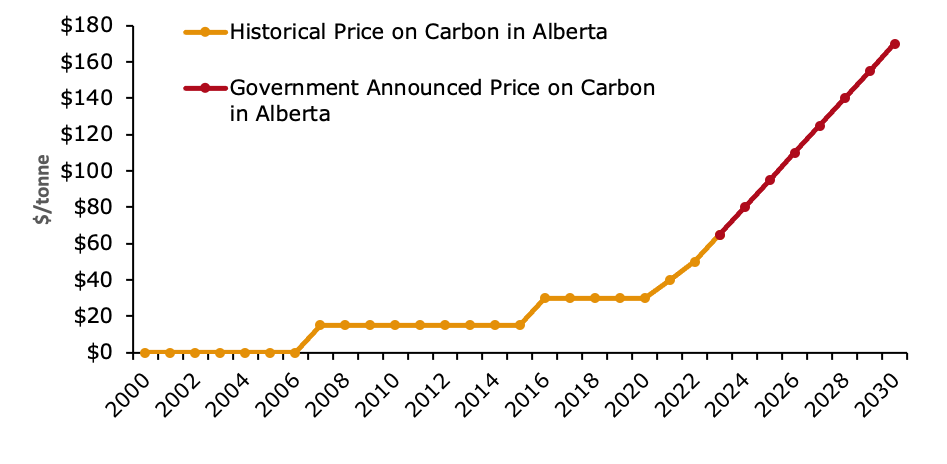

Additionally, the federal government has announced that it will be raising the carbon price $15/year from the current price of $65/tonne in 2023 to $170/tonne in 2030. This increase will see the value of the carbon emissions reductions rising at a compound annual rate of ~15% per year, further enhancing the value to the PPA Buyer.

As a result of strong economics for PPA transactions, PPAs with utility-scale wind and solar energy generation projects in Alberta have rapidly increased over the past two years. To put it into perspective, the installed generation capacity of utility-scale wind and solar energy projects in Alberta that entered into PPAs with private corporations alone increased by over 6x in 2021 in comparison to 2020.

And in 2022 alone, Lafarge, Pembina Pipeline, Shopify, RBC, Bullfrog Power, Scotiabank, Microsoft, MEGlobal, Pembina Pipeline, and the City of Edmonton have all signed PPAs with wind and solar energy projects in Alberta totaling 650MW of AC renewable energy generation capacity.

How To Source A PPA and Maximize the Value of Your Contract?

Each wind farm and solar energy project will have different economics based on variables such as its interconnection costs, project size, the cost effectiveness of the project design, and its procurement and construction costs.

Furthermore, some project owners have a higher cost of capital and return expectation than others, driving up the rate at which they are willing to transact under a PPA.

While the headline price at which the sloar power is purchased often gets the most attention, other aspects that can have a greater impact on the value of the PPA contract to the PPA Buyer include: the track record and expertise of the project developer, the electricity generation profile of the project, the electricity generation profile of the customer (for Alberta based load), the location of the project, the date at which the project reaches commercial operation, and the allocation of risk and guarantees provided within the contract itself.

In order to maximize the value of a PPA contract, PPA Buyers should:

1) Aggregate with other buyers to increase their purchasing power and transact with larger projects that benefit from economies of scale pricing;

2) Screen projects for development status and project risks;

3) Screen developers for experience and ability to execute;

4) Run a competitive process to evaluate multiple offers;

5) Conduct financial modelling to quantify the value and risk associated with each offer; and

6) Negotiate a contract that properly allocates the risk.

To summarize, while price is an important aspect of a power purchase agreement, it isn’t the only item that matters. Simply put, price is what you pay, value is what you get.

Seeking to strengthen your team's financial modelling capabilities?

Zenith Power takes pride in creating user-friendly, visually appealing, and bankable financial models that simplify your investment decision-making process.

Microsoft Excel can be a fantastic tool when its functionalities are used as intended. Unfortunately, most users have no formal training on this platform, which can result in mind-numbing spreadsheets of information, or worse, misinformed investment decisions. Whether it’s tracking a project development budget, creating a bottom-up capital expenditure model, conducting cash flow analysis, evaluating project economics, or running multiple project design and financing scenarios, Zenith Power can support your team’s renewable energy investment decision making process by creating robust, visually appealing, and user-friendly financial models and investment decision making tools.